Skewer me if you want, but at least be informed when doing it.

Some members of the public seem to be very angry over a motion I recently moved and have made the assumption that I have removed very important public reporting – removing quarterly council expense reporting – this is not true so let me clear up the confusion.

What happened?

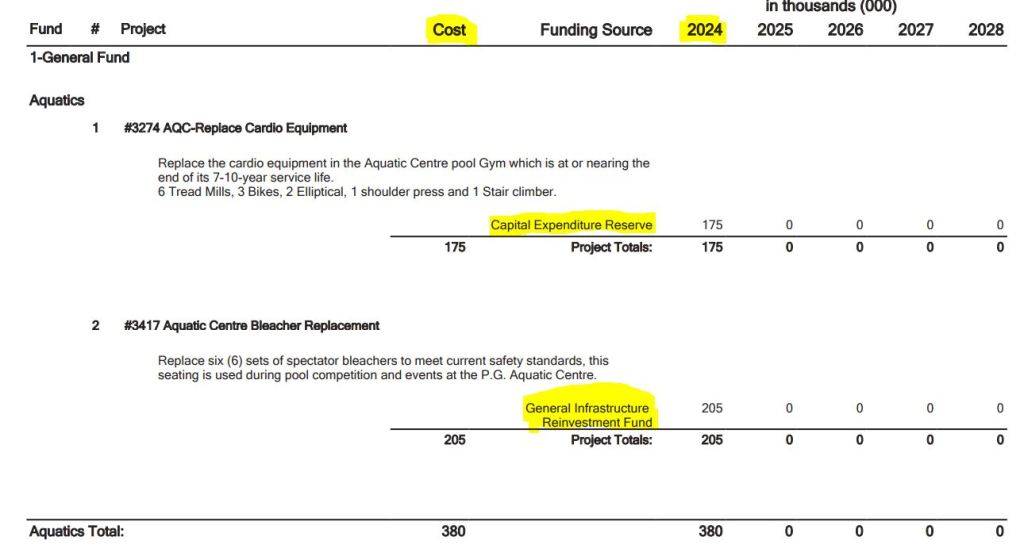

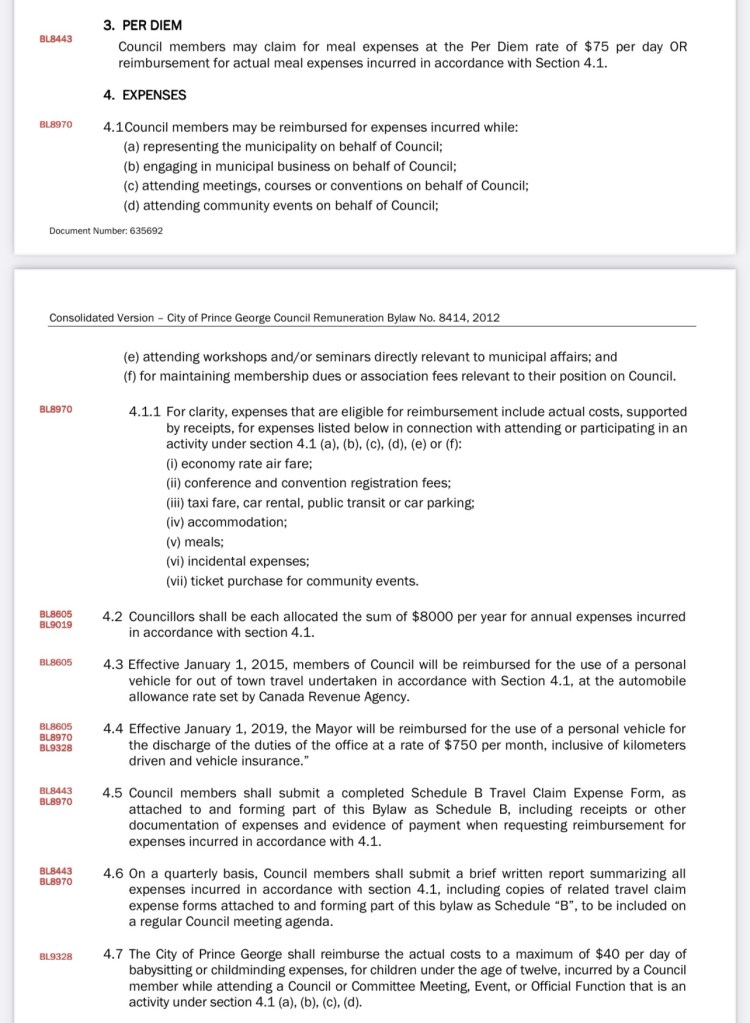

Every year in June, council reviews our Statement of Financial Information colloquially referred to as the SOFI report. This report contains all legislatively required reporting on things like salaries and expenses for employees earning over $75,000. Every employee that meets this criteria are listed on this report for the public to review and provide comment on. This report also includes things like council expenses (including who did and who did not go over their allocated budget), contracts over $75,000 and much more. It typically receives much attention and if you’ve never reviewed it, I’d recommend checking out the 2024 version here.

At the June meeting, while reviewing the SOFI report, a member of council, without a notice of motion, put forward the following resolution:

That council directs administration to report to council on expenses in the same manner as the council currently reports of the city manager, directors, the manager of legislative services, and the deputy corporate officer on a biannual basis.

Council is a governance board, not an operating board, and by legislation, operational duties of the city are delegated by council to the city manager, which includes oversight of employee expenses. Under the one employee model, council reviews the city managers expenses and the city manager reviews employee expenses. It’s a pretty straight forward governance practice.

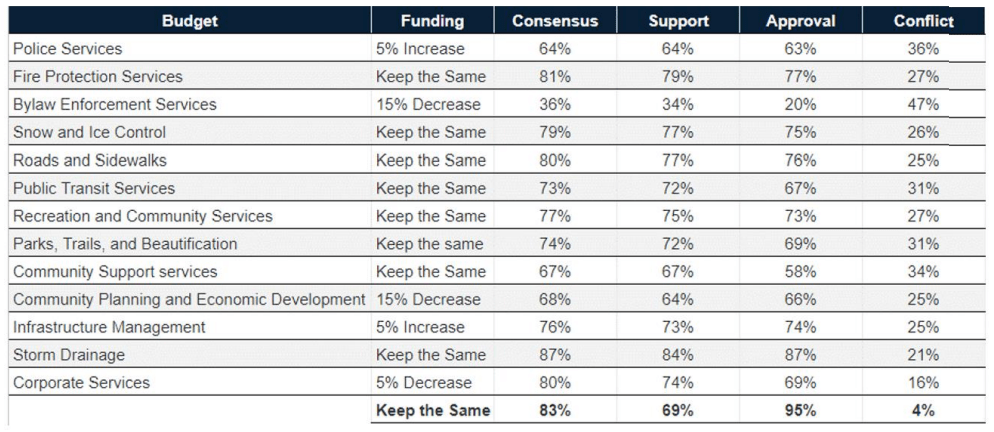

I opposed the original motion because I felt this was redundant due to the SOFI reporting already providing this information, and also, this to me is overstepping our governance role and delving into operations. I felt that with only 9 employees identified in the motion being required to do additional reporting, this would create some public criticism into things like professional development training these individuals are taking; it would impact morale due to public scrutiny of only some employees receiving additional twice yearly criticisms over spending that has been approved in the budget set by council. Finally, as Prince George is the only municipality in all of BC to adopt this practice, I also worried that this would impact our recruiting efforts and succession planning. Despite my objections, the motion narrowly passed.

Fast forward to Monday’s meeting – where we for the first time reviewed the actual reporting that came about as a result of councils motion. I found some red flags and discrepancies in the report. For example, members of council attended the FCM conference in May bringing with us the city manager and our Director of Development Services. While the City Manager and Director had these expenses listed publicly in this report, it does not show the full picture and is very misleading to the public because there was also another employee who attended the conference who was not required under this reporting process to report expenses. For the record, all employees earning over $75,000 already have their expenses publicly reported in the SOFI report.

Why are council expenses shared on an open meeting agenda?

Let me explain it this way: if you were to review the organizational structure of the city, you would see that employees report to the city manager – who reviews employee expenses; the city manager reports to council – who reviews the city managers expenses; and council reports to the tax payers – who review our expenses. I want to state for the record that I firmly believe that it is important for the public to be able to review our expenses as members of council and I have not removed this reporting – this is still in place. I think it is important for you to see which of us is over and under on our expense budgets because we ultimately report to you. That is transparency and accountability in action and all members of council report our full quarterly expenses on the quarterly report – not a subset of members unlike the motion which asked that only 9 specific staff members share their expenses in addition to the already public reporting in the SOFI report.

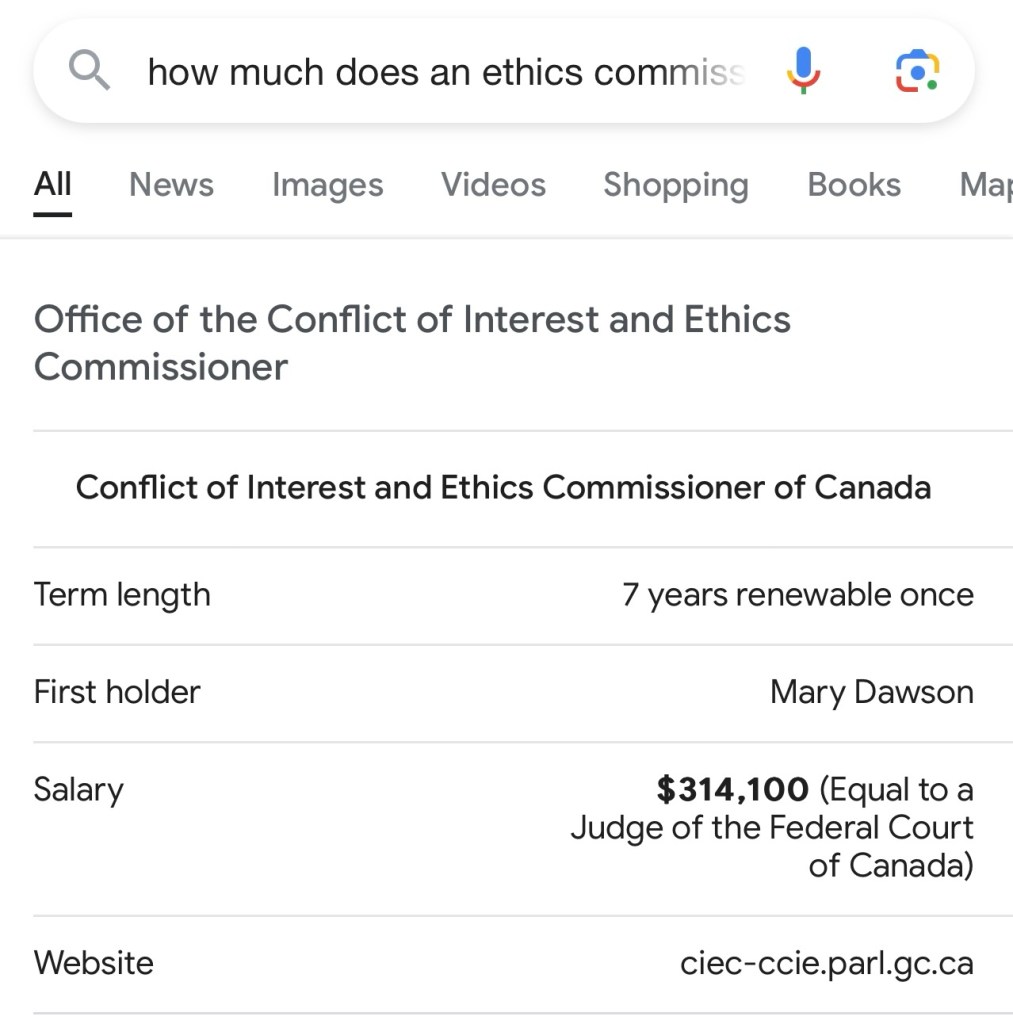

I do want to add some commentary around transparency because this word is thrown around a lot and sometimes even weaponized. I know full well that residents want full transparency on every single decision we make, and the rhetoric in this era of distrust typically indicates that you don’t have full transparency unless you yourself get to delve into the general ledger lines of every single dollar we spent because seeing is believing. The reality is that council from time to time has to deal with confidential information as any business does. There is an extraordinary cost to the taxpayers if the city were to not keep information confidential when appropriate. New businesses looking to come to the city wouldn’t trust us, our position on certain matters could be strategically jeopardized, the province would very likely stop giving us grant funds, special and major events would be jeopardized, and we could potentially open ourselves up to a lawsuit – these are just some examples that come to mind.

So how do we ensure the public gets accountability when they don’t fully see everything? For me, this is my role as a councillor. You have elected me to be your eyes in the open and closed meetings and I greatly enjoy being your little truffle pig, sniffing out the goods and getting what I believe is the best outcome for residents.

Getting back to the motion. It should be noted that if council wants to discuss an individual line item in the SOFI report, it must be moved to the closed council meeting because it then becomes subject to PIPA and is considered personal information protected by legislation. I would opine that this additional redundant report could potentially breech PIPA and put us at risk.

So what exactly did I change that was supported by a majority of council?

I reviewed the report on staff expenses for Q1 and Q2 and determined that it was very lacking because we already get a more fulsome report with so much more information – and hey, everyone who is supposed to be on it, is on it. I still wanted to respect the original motion that was put forward so I suggested a change in council direction that upheld our position as a governance board. Rather than reviewing this secondary report in an open meeting with only 9 staff, I proposed that we review the city managers expenses in the closed meeting and direct the city manager to review staff expenditures regularly. This maintains good governance ensuring council is not delving into operations, and still gives council the opportunity to review expenses and ask pointed questions – your elected eyes doing their job.

To sum it up: the public already gets a much better report publicly sharing information on staff expenses. The new additional report that didn’t really show anything and was quite misleading has been removed and instead, the city manager will share his expenses in a closed council meeting regularly with council.

If you have questions or need further clarification, please get in touch – you can find info on my contact page. I am more than happy to discuss and clarify to ensure you feel as confident as I that this decision was in the best interest of the city.