I wanted to write a blog on budget last week but then I had the Regional District budget and regular meetings so unfortunately it’s a little delayed but hopefully you find the information helpful.

I’ll start by saying that there is a lot of work that goes into the city budget and the process for the 2024 budget kicked off in August 2023 at the Finance and Audit (F&A) Committee which I chair and consists of Councillors Bennett, Polillo and Klassen. At the August meeting, F&A reviewed the budget consultation approach and made a recommendation to council (committee’s do not have the ability to make decisions on their own so we make recommendations to council and they can choose to adopt, amend, or halt a process) on the process which was approved.

Budget Consultation 2024

Our budget consultation included a number of engagement opportunities. The City of Prince George ran five satisfaction surveys on: roads and sidewalks, parks and trails, events and recreation, snow and ice control, and protective services. Each survey had between 200-300+ responses. We also ran 24 social media posts asking for feedback on various topics which generated hundreds of comments. Citizen Budget, which some might be familiar with, is a survey we run every year as part of our budget consultation and saw 1,500 visitors in 2023. Finally, council also put on three public input sessions in the Hart, Downtown and in College Heights to hear feedback in-person from residents. Budget consultation runs throughout October every year and there are many ways to engage and tell us what you think. Members of the public can also email council or send letters of correspondence. Overall, I think we have a robust engagement process that considers feedback from different mediums and sources. If you think this process can be improved upon, please let me know your thoughts!

What We Heard

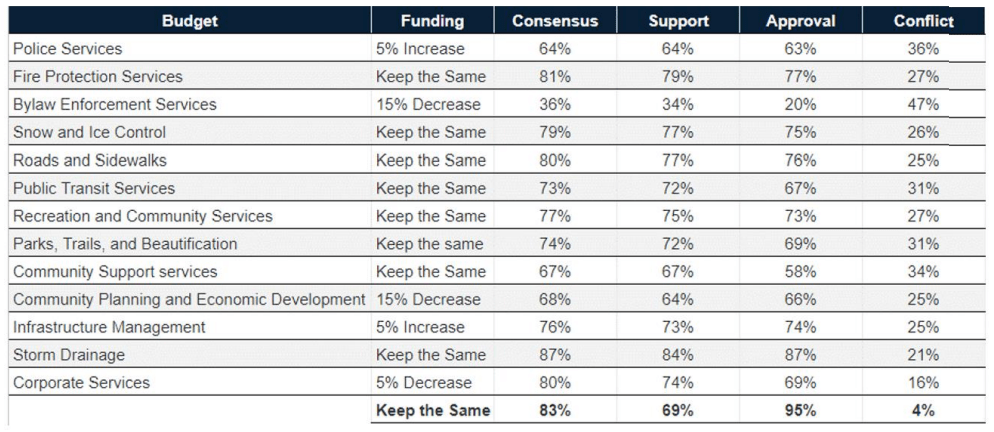

There’s a lot of information and feedback to sift through but below shows the Citizen Budget survey results (keeping in mind that there is a lot of info collected in addition to this like the other surveys and social media comments but this does summarize for the sake of a blog a general idea of feedback from the public). You can view the entire results of the budget engagement here at item D.1.

Looking at the table below, we can see that residents have asked for increases and decreases in specific areas, but overall 83% asked that service levels remain the same. Considering inflation was at 3.4% in December, to keep service levels the same, we are automatically without changes looking at the inflationary increase. Now, 3.4% is much different than the 6.24% which includes some increases, but it equally important to note that the 3.4% inflation rate is based on a basket of goods that includes household items, not things like construction materials and asphalt so the inflation rate for municipalities tends to be higher.

There are other factors that require us to consider differing from the feedback in the Citizen Budget results. An example of this is Fire Protection Services which saw five new firefighters and one new admin added as an enhancement. This was due to a report council received in March 2023 which you can view here at C.1 which can be summed up as: “Following through on the 5-year staffing plan will bring the Fire Department within compliance of NFPA 1710, ensuring the appropriate number of firefighters on scene to fight residential structure fires in the recommended length of time.” So that for me was a very good reason to differ from the public recommendation of ‘keep the same’ given that not following this recommendation could have liability issues and impact life saving measures by our fire department.

The Financial Plan

The financial plan – which is the operating budget – is very complex and sometimes it’s not the easiest to understand so I’m going to try and break it down in what I hope is an adjustable format. Essentially, this is a $166.4M budget and a 1% increase is equal to $1,292,482. The $166.4M amount excludes the additional $59.7M we collect for other agencies such as the School District, the Regional District, 911, the Regional Hospital, BC Assessment, etc. which you will see on your tax bill.

Over all, the tax levy is made up of four individual levies:

- The first levy is General (operating) which consists of the operating funding for all city services except for off street parking, snow, solid waste, sewer, water, and district energy because they have their own fund which collects their operating monies. The general levy collected $110,398,156 in 2023 and saw a 4% increase in 2024 bringing it to $116,396,345 for 2024.

- The second levy is General Infrastructure Reinvestment Fund (GIRF). This levy was started in 2016 when council realized we had a significant infrastructure funding gap we needed to close. Since 2016, this fund has grown to $2,950,000 but with minor contributions of between $50,000-$75,000 over the past several years, we know that it is not enough to fund future capital projects. Earlier this year a recommendation was passed in our Finance Policy that would see 1% of the tax levy will be set aside to fund GIRF. Within the tax levy you will see that 1%, or $1,292,482 which brought GIRF from the $2,950,000 to $4,242,482 in this budget cycle. Now we might not need to fund GIRF at this level forever, but several years at 1% until the funding gap is closed will be necessary to fund our future infrastructure reinvestment needs.

- The third levy is Snow. We collected $9.8M in 2023 and the 2024 budget saw a recommended increase of $1M ensuring we keep a healthy reserve of 25% of the snow budget so that if we have a snowpocalypse event (or many) we can use the reserve to cover any overages. This recommendation, if approved, would have brought the snow levy to $10.8M in 2024.

- The final levy is Road Rehabilitation which collected $6.1M in 2023 and had a recommended increase of $600,000 in 2024. This lets us complete 50 lane km’s in the city every year. At F&A we did hear that asphalt is seeing a huge inflationary increase meaning that the city could see the $141 per ton rate increase to $200 per ton for smaller jobs. F&A passed a recommendation that council consider an enhancement in the amount of $300K which would bring the overall levy with the proposed increase to $7M. This would still bring us short of our infrastructure funding gap by $1.2M.

With all that, not including the enhancements, the proposed tax levy was at 6.24%. Council made some changes to the proposed budget from staff. Rather than increase snow by $1M, we chose to increase by $500K which would still fund the levy but have us rely on the reserve in 2024 should we see significant snowfall activity. Service levels to snow removal have not been changed so this means using the savings we have in the bank to fund the bill if we go over the $10.3M budget. We also saw proposed changes by colleagues that did not pass.

What does 0% look like?

As we go through the 2024 and previous budgets, thinking about that 1% = $1,292,482 (in 2024) is an important consideration, for me at least. People often ask the question, why can’t we have a 0% increase? To get to 0% would require council to cut $8,065,087.68 in the 2024 budget. To cut that amount would mean residents would experience significant impacts to service levels across multiple divisions.

But we had a 0% in a covid year? Yes, we technically had a 0% tax levy in 2021 followed by 3.00% in 2022 and 7.58% in 2023. Now we have 6.78% in 2024 and likely several years of mid-5-6% increases where we are recovering from the 0%. This is because to get to 0%, council did not cut services and instead used a one-time funding source (the COVID-19 Safe Restart Grant), to fund the inflationary increase meaning that once the one-time money was no longer available, we had to fund it through the levy. I did not support the 0% for this reason and it is my opinion that we will be recovering from the 0% for quite some time.

Capital Plan

In 2024, we see a capital plan for $46.8M with $15.2M for new/upgrade projects and $31.7M for reinvestment type projects. When looking at the capital plan (which consists of funded projects, unfunded projects, and future years projects), I like to reference the reserve balances because while GIRF does impact the tax levy (remember that 1% we collected above for our infrastructure reinvestment gap?), there are ways we can fund capital projects where it doesn’t impact the levy, like if we get grant funds or gas tax money from the feds/province.

Let’s start off by addressing ‘what is a funding gap’? This is the amount of money we need to collect to replace our current infrastructure. Looking at the next ten years, there are civic facilities that need reinvestment in order to remain operational. For instance, if we look at the PG Playhouse, we can see that in order to keep it functioning, it will likely require $2,142,299 within the next ten years (and if we ask the other question, it’s much more than $2M). Overall, just for the facilities listed below the reinvestment amount is $46M and requires $4.6M per year to get us there. Keep in mind that this is just for 7 facilities and doesn’t include other reinvestment that is also required like for parks, trails, roads, etc. Remember that GIRF levy that was at $2.95M? That’s why we need to fund GIRF at 1% of the levy per year – so that we increase it incrementally rather than all at once to have the funds necessary to reinvest into our infrastructure (Google Osoyoos 39% increase if you want to know how bad it can get).

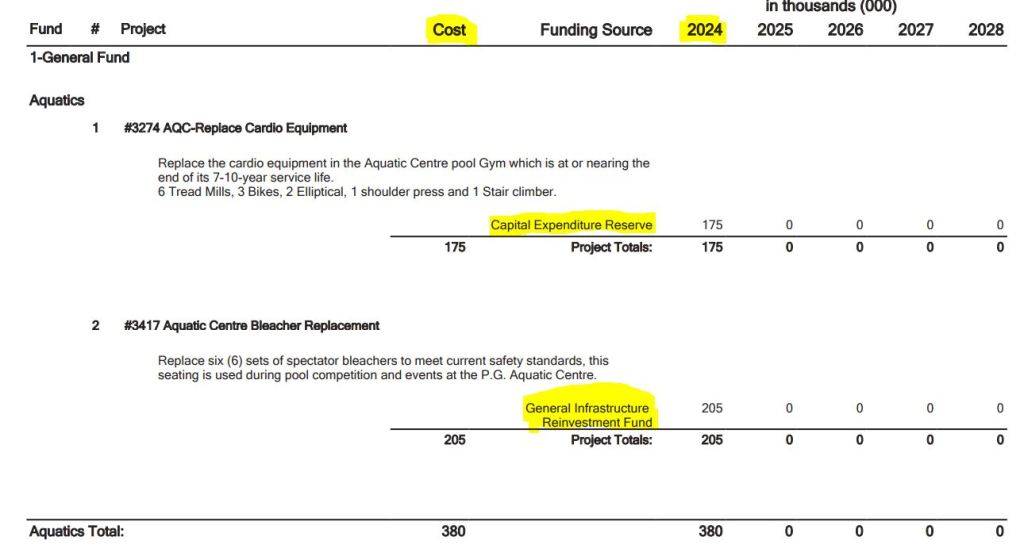

Next, let’s look at the two funded capital projects. The first is project #3274 which would see the cardio equipment at the Aquatic Centre pool gym replaced. We can see that this is funded at $175K in 2024 from the Capital Expenditure Reserve.

This is where referencing reserve balances comes in handy. If we look at the Capital Expenditure Reserve balance (this reserve does not impact the tax levy as it is funded by an annual contribution from our gaming revenue (money we get from the province from the casino) as well as interest we get on our endowment reserve) we can see it has a balance of $2.8M on Dec 31, 2022 and also would have also received the 2023 gaming contribution as well, so the balance is likely somewhere in the ballpark of $5.8M.

Then we ask the question, is it necessary to fund in 2024 – what advantage does this provide? Well, we heard that the equipment is at the end of its life and this is a decent revenue stream for the Aquatic Centre, so funding it would ensure that revenue stream remains in place. You might look at the $175K and think that’s a lot for 6 treadmills, 3 bikes, 1 should press and 1 stair climber. It’s important to note that city staff will look for ways to find savings and if we do save, they will return the unspent savings to the reserve which can be used for future projects.

The second capital project is #3417, the Aquatic Centre bleacher replacement project which sees the replacement of the bleachers at a cost of $205K from GIRF. Now this is a project that does impact the tax levy. Choosing to not fund this project could see the tax levy reduced but we could also choose instead of reducing the tax levy to fund the GIRF reserve to ensure we’re maintaining that 1% for the infrastructure funding gap. We did hear that regardless of funding this project or not, the bleachers are at end of life and need to be removed due to safety issues so funding this project made sense.

Council went through the capital plan project by project asking questions, and getting more information and then we went through the capital project again for approval and decision. At the end, there were projects that were funded, projects that were moved to unfunded, as well as projects from unfunded and future years that were forwarded to Committee of the Whole for more information.

Enhancements

Enhancements are things that are changes from the status quo budget or things that residents or council ask for throughout the year. This year we had a number of enhancements for consideration. Without making changes to the budget and approving the enhancements as is, this would have put us at a 8.23% tax levy. Basically we reduced the levy by 1.45% or $1.87M. Here’s how we did it:

RCMP asked for four new officers at $883,128, this was instead funded for four officers starting July 1 at $441,564 shaving off 0.34% from the 8.23 levy. Next was police support which asked for two municipal staff in the amount of $160,960. Council approved one of the two positions for $77,923 shaving another $83,037 off the levy.

Next was an increase to the fire department which asked for 5 firefighters and 2 support staff. Council approved the $594,220 as well as $76,519. The full enhancement request was for $907,327 so there was a further reduction here. We also saw that by delaying the hiring of the new firefighters, we could fund the Phase 2 Fire Training Feasibility study without increasing the levy which was Councillor Sampson’s idea and passed.

The REAPs request of $100k was not supported and the Exploration Place saw their request partially funded at $25k + $25k rather than the $25k + $75k they requested.

Finally, the roads enhancement of $300k that F&A put forward did not pass. I would have liked to see us try and increase this to decrease the funding gap but I understand why it was unappealing.

The 6.78%

My hopes in writing this blog is to give you a different perspective on the budget process and share my opinion, learnings, and understanding. Budget is a balancing act and I do believe that council did great job finding ways to reduce that initial 8.23% down to 6.78%.

Thanks for reading! If there are any questions, comments, considerations, please don’t hesitate to get in touch.

HI, Cori

thanks for your recent posting about the budget.

You incorrectly stated: “The REAPs request of $100k did not pass and the Exploration Place saw their request partially funded at $25k + $25k rather than the $75k they requested. ”

“not pass” implies that the request was voted on and defeated, not that it never even came up for discussion.

From what I read in minutes REAPS request never came up for discussion….therefore could not of been voted on and hence defeated.

REAPS looks forward to continued serving our community and the RDFFG and developing partnerships and enhancing the City’s initatives.

sincerely, terri

LikeLiked by 1 person

Hi Terri,

Thanks for the comment. I really appreciate you bringing this forward. I know there was an opinion piece about council not considering this and ‘sending a grim message to non-profits’ but I do not agree with that perspective. We did have a discussion on the topic on Monday and this is reflected in the video recording of the meeting. Other enhancements that were also not supported (I will change the wording in the blog to say not supported instead of not passed so it’s clearer) in a similar manner were for a fire prevention inspector and a fire training captain. While the minutes reflect that no motion was put on the floor for debate for these items, we did discuss it during the question period.

Happy to chat more about this if you need further clarification.

Thank you for the work you do for our community!

-Cori

LikeLike